2025 Irs Standard Deduction Married Jointly

2025 Irs Standard Deduction Married Jointly. The top tax rate will remain at 37% for married couples filing jointly,. The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill.

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; And the standard deduction for heads of.

Married File Joint Standard Deduction 2025 Renae SaraAnn, The maximum zero rate amount cutoff is.

Standard Deduction 2025 Married Filing Joint Declaration Kass Sarene, Publication 17 (2025), your federal income tax

Standard Deduction 2025 Married Filing Jointly Married Filing Jodie, These amounts are provided in the.

2025 Standard Deduction Married Joint Irs Dasie Julienne, The amt exemption amount for 2025 is $85,700 for singles and $133,300 for married couples filing jointly (table 3).

2025 Standard Tax Deduction Married Jointly 2025 Sonia Eleonora, 2025 alternative minimum tax (amt) exemptions filing status

Standard Tax Deduction 2025 Married Jointly Married Aime Lorita, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if.

Tax Brackets 2025 Married Jointly Irs Standard Deduction Gray Phylys, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750.

Married File Joint Standard Deduction 2025 Ashlan Kathrine, For single taxpayers and married individuals filing.

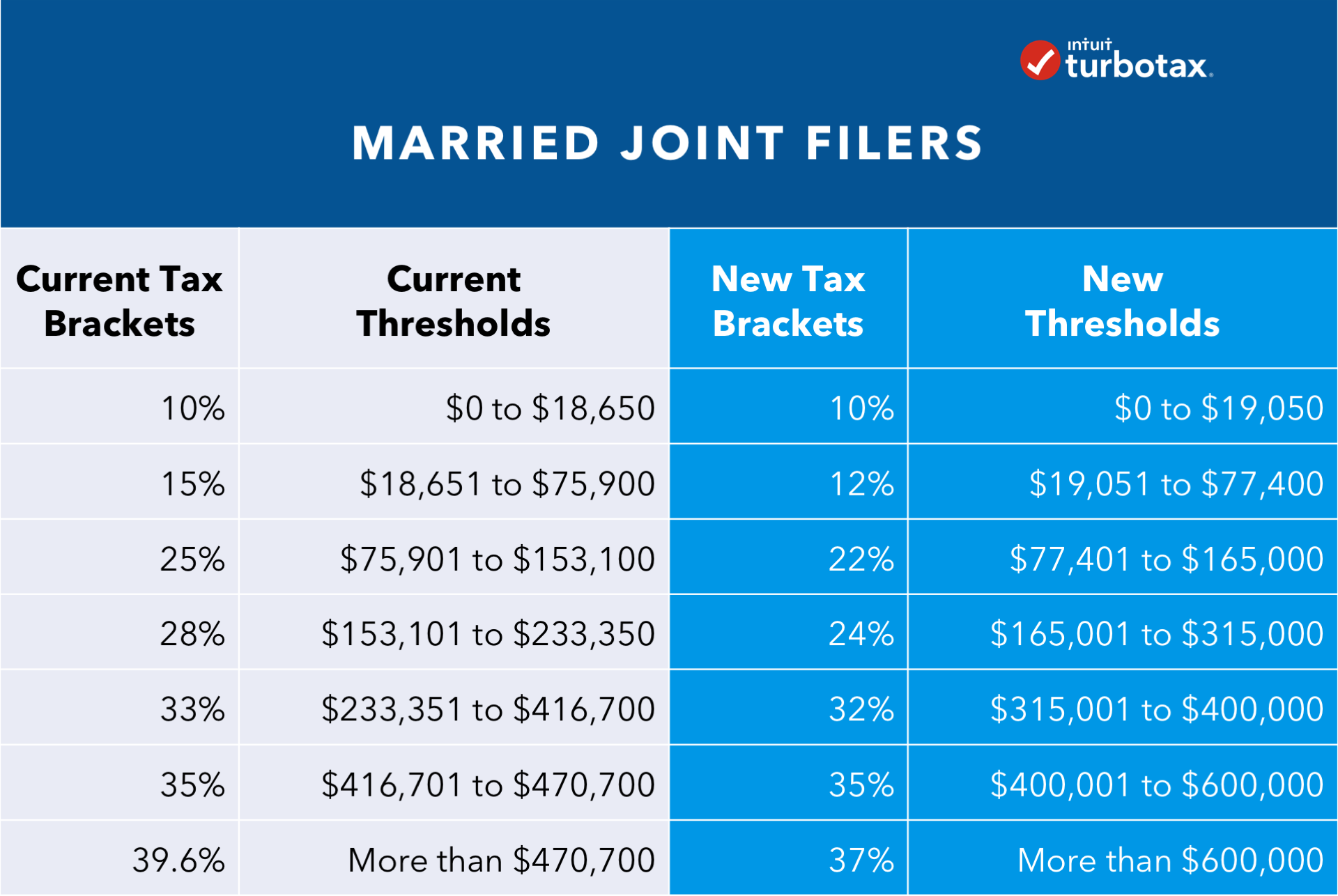

What’s My 2025 Tax Bracket? Wells, Roselieb & Raia Wealth Management, LLC, Your itemized deductions need to exceed that dollar amount for itemizing to reduce.